What Is SR&ED Tax Credit A Guide for Canadian Innovators

If you've ever wished you could get paid for the trial-and-error that comes with innovation, you’re in luck. The SR&ED tax credit is a powerful government incentive that essentially gives Canadian businesses cash back for their research and development efforts.

Think of it as the government co-investing in your company's innovation. It helps cover a big chunk of your R&D costs—whether your project ultimately succeeds or fails. This makes it one of the most generous sources of non-dilutive funding you can find.

A Founder's Guide to the SR&ED Program

Imagine turning a portion of your development team's salaries, project materials, and even some overhead costs into a direct cash refund. That's exactly what the Scientific Research and Experimental Development (SR&ED) tax credit program does. It’s Canada’s biggest tool for encouraging businesses of all sizes to push boundaries and stay competitive.

This isn't a grant you have to win in a competition. It's a tax incentive you're entitled to claim for the innovative work you've already done. The whole point is to reward the process of experimentation and problem-solving, not just the final, polished outcome.

To help you get a quick handle on the key terms, here’s a simple breakdown of what they mean for your business.

SR&ED Tax Credit At a Glance: Key Concepts Explained

| Concept | Simple Explanation | Why It Matters for Your Business |

|---|---|---|

| SR&ED Tax Credit | A government program that provides cash refunds or tax credits for eligible R&D work conducted in Canada. | It reduces the financial risk of innovation, freeing up cash flow for you to reinvest in growth, hiring, or new projects. |

| CCPC | Canadian-Controlled Private Corporation. A private company controlled by Canadian residents, often an SME. | CCPCs get the best deal—a higher, fully refundable tax credit rate, which means cash in the bank even if you don't owe taxes. |

| Qualified Expenditures | The specific costs you can claim, like salaries, materials, and some overhead related to your R&D work. | Knowing what counts is key to maximizing your claim. This is where most companies leave money on the table. |

| Non-Dilutive Funding | Money you receive without giving up any ownership or equity in your company. | Unlike venture capital, SR&ED funding doesn't dilute your stake. You keep 100% of your company. |

This table is just a starting point, of course. The real value comes from understanding how these pieces fit together to support your specific projects.

Who Benefits Most from SR&ED?

While any Canadian company can apply, the program is deliberately designed to give the biggest boost to Canadian-Controlled Private Corporations (CCPCs). These are your typical small and medium-sized businesses (SMEs) that drive so much of our economy.

Why the special treatment? It’s simple: smaller companies usually face the biggest financial hurdles when it comes to funding R&D. By offering a more generous, refundable credit, the government helps level the playing field and fuel their growth.

For a small business, SR&ED isn't just a tax credit; it's a lifeline. It can dramatically extend your startup's runway. CCPCs can get a fully refundable 35% credit on up to $3 million in qualified expenditures each year.

The Core Purpose of the Program

At its heart, the SR&ED program is all about de-risking innovation. The government gets that pushing technological boundaries is messy and uncertain. Things don't always work out. By offering this incentive, they encourage companies to take on those tough, ambitious projects they might otherwise shelve due to cost.

This has a ripple effect across the entire economy:

- It Fosters Real Innovation: Companies are motivated to develop new products, better processes, or groundbreaking materials.

- It Creates High-Value Jobs: R&D requires skilled people—engineers, developers, scientists, and technicians.

- It Boosts Global Competitiveness: It helps Canadian companies go toe-to-toe with international firms that have massive R&D budgets.

This gives you the big-picture view of what SR&ED is and why it's so important. For a deeper dive into the nuts and bolts from the government's perspective, check out our guide on the Canada Revenue Agency SR&ED Investment Tax Credit. In the next sections, we'll break down exactly who is eligible and what kind of work qualifies.

Determining Your SR&ED Eligibility

Figuring out if your project actually qualifies for the SR&ED tax credit can feel a bit like navigating a maze. But don't worry, it's not as complex as it first seems. The Canada Revenue Agency (CRA) has laid out a clear path based on three core questions.

This isn't about whether you have a formal R&D department or fancy lab equipment. It’s all about the nature of the work your developers, engineers, and technicians are already doing. Think of it less like a rigid checklist and more like telling the story of your innovation journey.

The Three Pillars of SR&ED Eligibility

To build a solid SR&ED claim, your project needs to stand firmly on three pillars. Answering a confident "yes" to each of these questions is the bedrock of a successful application.

- Was there a technological uncertainty? This is the "why" behind your project. It means you ran into a technical wall where the answer wasn't just sitting in a textbook or available online. You were trying to do something that pushed beyond standard practice.

- Did you follow a systematic investigation? This is the "how." You have to show that you didn't just get lucky and stumble upon a fix. Instead, you need to prove you followed a logical process—forming ideas, testing them out, and analyzing what worked (and what didn't) to move forward.

- Did you achieve a technological advancement? This is the "what." The whole point of the work must have been to grow your company's own technological knowledge base. And here’s the crucial part: this advancement is about the knowledge you gained, even if the project itself didn't pan out or isn't finished.

A project that just involves using well-known techniques or making routine tweaks won't make the cut. The magic ingredient is a genuine technical challenge that forced you to experiment to find a solution.

Unpacking Technological Uncertainty

The concept of technological uncertainty is often the biggest hurdle for businesses to grasp. This has nothing to do with whether your project was a commercial risk. It’s all about a situation where your team genuinely couldn't know for sure if a technical goal was even possible, or how to get there using existing public knowledge.

Let’s say a software company is trying to build a new algorithm that crunches data 50% faster than any off-the-shelf solution. The uncertainty isn't "can we write code?" It's "can we hit this specific performance target, and what technical path will get us there?" Their systematic investigation would be the process of building and testing different models, measuring performance, and iterating based on those results.

SR&ED rewards the methodical pursuit of knowledge in the face of the unknown. The focus is on the process of discovery and the new understanding it creates, not just the final product.

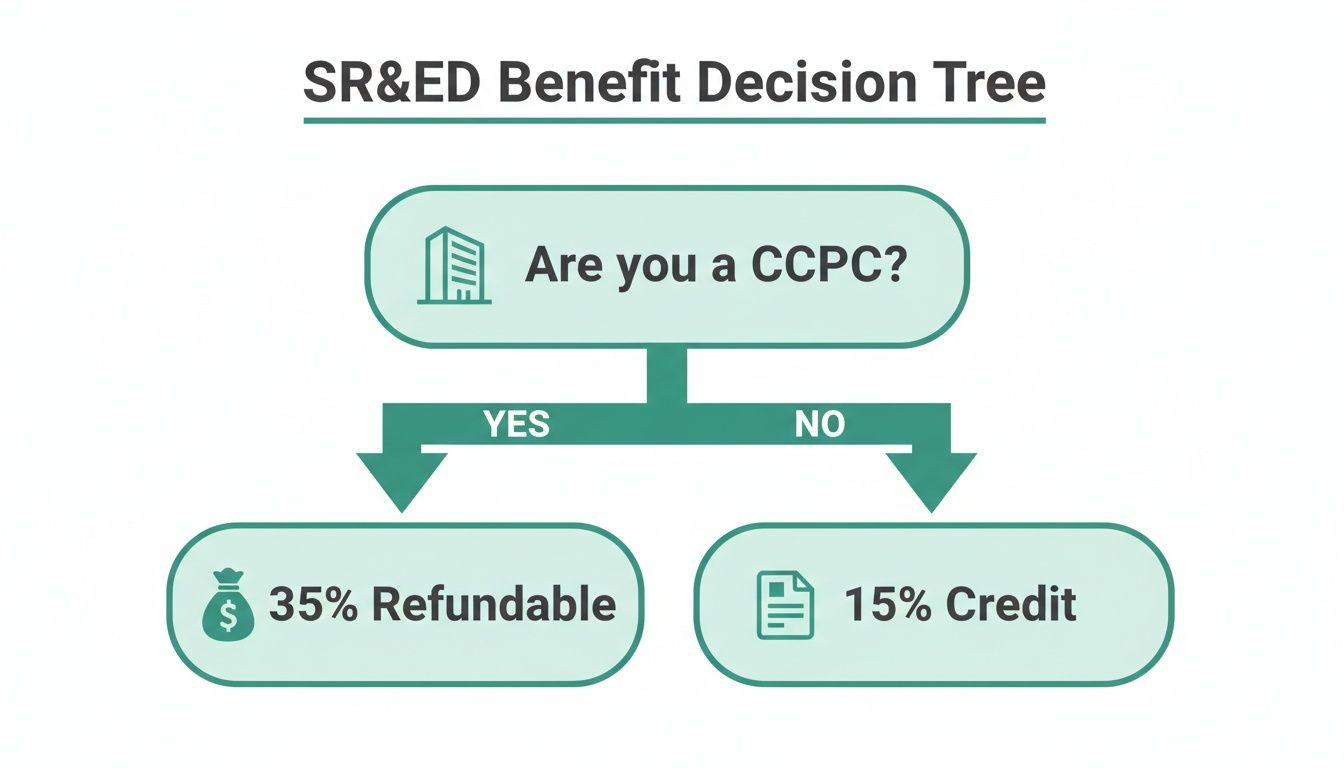

The type of business you run also plays a huge role in how you benefit. This decision tree breaks down how your corporate structure—specifically whether you're a CCPC—shapes the credit you can receive.

As you can see, Canadian-Controlled Private Corporations (CCPCs) get access to a very generous 35% refundable credit. Other types of businesses, like foreign-owned corporations or public companies, receive a 15% non-refundable credit.

Real-World Examples Across Industries

SR&ED isn't just for one type of industry. Innovation is happening everywhere, from the factory floor to the data centre. Here’s a look at how these principles apply in a few different fields:

- Manufacturing: A company is trying to develop a new composite material that’s both lighter and stronger than anything on the market. Their SR&ED work is the experimentation with different chemical formulas and curing methods, where they methodically test each batch to see if it meets their technical goals.

- Cleantech: A startup is working on a better water filtration system. The uncertainty is in creating a membrane that can trap a brand-new type of micropollutant without slowing down the flow rate. Their investigation involves prototyping and testing all sorts of membrane materials and designs.

- Software Development: A team is building a machine learning model to predict equipment failure with 99% accuracy, a huge leap beyond current industry benchmarks. Their eligible work involves experimenting with new neural network architectures and data processing methods to push the limits of what's possible.

In every one of these cases, the company isn't just making a product; it's systematically working through a technical problem that has no known answer. Once you start looking at your work through this lens, you might be surprised to find eligible SR&ED happening right under your nose.

What You Can Actually Claim Under SR&ED

Okay, so you've confirmed your project fits the SR&ED criteria. What's next? The crucial step is figuring out which specific costs you can actually put into your claim. Nailing this down is the secret to getting the most back and making sure your claim can stand up to scrutiny.

Think of it like building a case—you need the right evidence. For SR&ED, your "evidence" is the specific expenses directly tied to your R&D work. These aren't just any old business costs; they have to be directly linked to the people, materials, and contracts that made your experimental development happen.

The Core Buckets for Claimable Costs

Your eligible expenses will fall into a few main categories. If you get into the habit of tracking these properly throughout the year, you’ll save yourself a massive headache when it's time to file.

- Salaries and Wages: This is almost always the biggest piece of the puzzle. You can claim the portion of salaries for any employees who were hands-on with the SR&ED work. We're talking about your developers writing new code, your engineers building a prototype, or the lab techs running experiments.

- Materials Consumed or Transformed: If you're creating something physical, the cost of materials often qualifies. This means any raw materials that were either used up entirely (consumed) during testing or were fundamentally changed (transformed) into something new, like a prototype part.

- Payments to Contractors: Did you hire a Canadian contractor or a consultant to perform some of the SR&ED work for you? Good news—those payments can often be included. The key here is that their work must meet the very same SR&ED eligibility rules as your own.

And it's not just big corporations taking advantage of this. Small businesses are the heart and soul of the SR&ED program. According to the CRA's latest data, out of the $4.2 billion in tax credits handed out, a full 32%—that’s about $1.344 billion—went to companies with less than $4 million in income. You can dig deeper into these SR&ED statistics to see how it all breaks down.

Tackling Your Overhead: The Proxy vs. Traditional Method

Every R&D project has background costs—things like rent, heat, and admin support that keep the lights on. The CRA gives you two different ways to claim these overhead costs, and picking the right one can make a huge difference to your final refund.

It's a bit like choosing a data plan for your phone. One is a simple, all-inclusive flat rate (Proxy), while the other makes you track every single megabyte you use (Traditional). The best choice really depends on how you operate and how much you want to track.

The Proxy Method is the go-to for most small and medium-sized businesses, and for good reason: it’s simple. Instead of tracking every little overhead expense, you calculate a "prescribed proxy amount" (PPA). This is a flat 55% of your direct SR&ED salary base. So, if you have $100,000 in eligible salaries, you can simply add another $55,000 to your claim to cover overhead. No need to justify every hydro bill.

The Traditional Method, on the other hand, is for the meticulous record-keepers. With this approach, you have to identify, track, and claim the actual overhead costs that can be directly attributed to your SR&ED work. This might include a percentage of your rent, utilities, or the salaries of administrative staff who support your R&D team. It's a lot more work, but it can pay off if your real overhead is much higher than the 55% proxy.

For most businesses, though, the Proxy Method is the clear winner. It cuts down on the administrative burden and reduces the risk of having overhead costs challenged during a CRA review. By getting a firm grip on these claimable costs and calculation methods, you’re setting yourself up to build a solid SR&ED claim from day one.

How to Calculate Your SR&ED Refund

This is where the rubber hits the road—translating your innovation efforts into actual dollars and cents. Figuring out your potential SR&ED refund isn't just an accounting exercise; it's how you see the real financial firepower of this program. Once you understand the mechanics, you can forecast the return on your R&D spending and make smarter decisions for your business.

At the federal level, the calculation all comes down to your company's corporate structure. The program is set up with two different rates, strategically designed to give the biggest boost to smaller, Canadian-owned businesses.

Federal Credit Rates Explained

The key distinction is whether your business is a Canadian-Controlled Private Corporation (CCPC). If it is, you unlock the most generous version of the SR&ED tax credit. It’s a game-changer.

- For CCPCs: You’re looking at an enhanced, refundable tax credit of 35% on your first $3 million of qualified SR&ED expenses. The magic word here is "refundable." It means you get cold, hard cash back, even if you didn't owe any income tax for the year.

- For Other Corporations: Public companies, foreign-controlled businesses, and CCPCs that blow past the $3 million threshold can still claim a 15% non-refundable tax credit. This credit reduces the taxes you owe, but it won't result in a cash payment if you're not in a taxable position.

This two-tier system is no accident. It’s the government’s way of funnelling the strongest support to the small and medium-sized businesses that are the true engine of Canada’s innovation economy.

A Practical Calculation Example

Let's walk through an example to make this real. Picture a software startup in Ontario—a classic CCPC—that has identified its qualifying SR&ED work for the year.

Say the company spent $100,000 on the salaries of developers who were directly working on the SR&ED project. If we use the Proxy Method to account for overhead, the calculation is pretty straightforward.

- Direct SR&ED Salaries: $100,000

- Prescribed Proxy Amount (55% of salaries): $55,000

- Total Qualifying Federal SR&ED Expenditures: $155,000

Now, we just apply that generous 35% federal rate for CCPCs to the total expenditure pool:

Federal Refund Calculation: $155,000 x 35% = $54,250

Just like that, $100,000 in R&D salaries generated more than $54,000 in a federal cash refund. That’s non-dilutive capital you can pour right back into the business—maybe to hire another developer, buy new equipment, or simply give yourself a longer runway to innovate.

The Provincial Multiplier Effect

But wait, there's more. The money doesn't stop at the federal level. Most provinces have their own R&D tax credit programs that stack right on top of the federal SR&ED incentive, giving your total return a serious boost. The specific rates and whether the credits are refundable vary from province to province, so it's critical to know the rules where you operate.

Think of it as a partnership. Both federal and provincial governments are teaming up to fuel your company's growth. This powerful combination is what makes Canada's R&D tax incentive system one of the most generous in the world.

To give you a better idea of how these programs stack up, here’s a quick look at the credit rates in some of Canada's key innovation hubs.

Federal vs. Key Provincial SR&ED Credit Rates

| Jurisdiction | Credit Rate for CCPCs | Credit Type | Notes |

|---|---|---|---|

| Federal | 35% | Refundable | On the first $3M of expenditures. |

| Ontario (OITC) | 8% | Refundable | Complemented by a non-refundable credit. |

| Quebec | 14% - 30% | Refundable | Rate varies based on company size and type. |

| British Columbia | 10% | Refundable | For eligible R&D activities in the province. |

| Alberta (AIRTC) | 8% | Refundable | On the first $4M of expenditures. |

When you start adding these provincial credits to the federal amount, the combined refund can often climb to over 60 cents back for every dollar you spend on R&D salaries. This stacking effect turns the SR&ED program from a nice-to-have incentive into a core part of your financial strategy.

To dig deeper into the federal program specifics, you can check out our detailed breakdown of the CRA's SR&ED Investment Tax Credit.

Mastering Documentation for a Bulletproof Claim

An incredible SR&ED project isn't enough to get you a tax credit. The real secret? Proving you did the work. Think of your documentation as the complete evidence file you’d hand to a judge—in this case, the Canada Revenue Agency (CRA). Without solid, contemporaneous proof, even the most brilliant R&D can see its claim slashed or denied outright.

The trick is to stop thinking of documentation as a year-end scramble to find receipts. Instead, you need to weave it directly into your daily R&D workflow. This approach builds a clear, compelling story of your innovation journey, making your claim far more resilient if the CRA comes knocking.

Building Your Evidence File

To make your claim unshakeable, your documentation must cover two sides of the same coin: the technical work you did and the money you spent doing it. Every single piece of evidence should support the narrative of your project, from the initial "what if" to the final breakthrough.

Technical Evidence: This is where you show you hit a technological wall and used a systematic process to try and get over it.

- Project Plans: These are your starting blueprints, outlining your goals, the technical hurdles you expected, and your plan of attack.

- Test Logs & Lab Notes: Keep detailed records of every experiment. What variables did you test? What were the results? What did you learn?

- Version Control Commits: For software development, commit messages in platforms like Git are a goldmine. They create a real-time diary of your team’s progress, bug fixes, and iterative steps.

- Team Meeting Minutes: Notes from design reviews or technical huddles are perfect for showing your team brainstorming solutions and planning their next moves.

This isn't just about creating paperwork. It's about capturing the living history of your innovation as it happens.

Connecting Financial Records to R&D

Once your technical story is solid, you have to connect the dots to your financial records. The CRA needs to see a direct line between the money you spent and the eligible SR&ED work your team performed.

Financial Evidence: This is how you justify every dollar on your claim form.

- Timesheets: You need detailed records showing who worked on which SR&ED tasks and for how long. A vague entry like "R&D" just won't cut it—be specific.

- Invoices & Receipts: Keep the proof of purchase for all materials that were consumed or transformed during your experiments.

- Contractor Agreements: Any contracts with third parties need a clear statement of work that spells out the specific SR&ED activities they were hired for.

The goal of your documentation is to create an undeniable, time-stamped trail. It should allow a reviewer to follow your journey from the initial hypothesis, through the challenges and systematic steps you took, to the knowledge you ultimately gained.

This level of detail is non-negotiable, as the CRA scrutinizes claims very carefully. In the last fiscal year, total SR&ED claims reached $4.4 billion, but only $4.2 billion were approved. That $200 million gap highlights just how strict the agency is about seeing proof of technological uncertainty. You can dig into more of the official numbers in these SR&ED program statistics.

By embedding good documentation habits into your daily routine—like tagging SR&ED tasks in your project management software—you ensure you're always audit-ready. This simple shift turns what could be a stressful, backward-looking paper chase into a straightforward process of collecting the evidence you've already created.

Let GrantFlow Handle Your SR&ED Claim

Let’s be honest, navigating the SR&ED program can feel like a second job. Between figuring out which projects even qualify, meticulously tracking every single expense, and then trying to write a technical story the CRA will approve, it’s a massive administrative headache. But you don’t have to go it alone.

Think of GrantFlow as your expert partner, turning a process that feels overwhelming into something you can actually manage. Our platform is built specifically for Canadian SMEs to take the heavy lifting of claim preparation off your plate so you can get back to what you do best—innovating.

From Discovery to a Claim That’s Ready to Go

What if you could pinpoint your eligibility, get your forms ready, and write your technical project descriptions in a fraction of the time it usually takes? That's exactly what GrantFlow’s tools are designed for.

Our platform guides you in creating the detailed technical narratives the CRA needs to see, making sure the story of your project’s uncertainty, systematic work, and progress is told clearly and convincingly. It also takes care of populating the critical T661 forms automatically, which cuts down on errors and saves you from hours of tedious manual entry.

GrantFlow is like having an SR&ED co-pilot. We help you stay on top of deadlines and keep your documents organized, giving you peace of mind that your claim is as strong as possible and ready for scrutiny from day one.

For businesses using GrantFlow, we scan your profile against 785+ funding opportunities to get your tax credits into your bank account faster. Imagine getting $700,000 back on $2 million in R&D spending, with a claim prepared by our AI writer in just days, not months. And with the phase-out thresholds recently increased to $15-75 million in taxable capital, even more growing SMEs can access this non-dilutive funding. You can discover more about the latest SR&ED program updates to see how they might affect you. To see all the programs you could be eligible for, visit https://grantflow.ca.

How One Startup Nailed Its Refund

We worked with a small software company that was on the fence about applying for SR&ED. They were worried about the mountain of paperwork and the risk of being rejected. Once they started using GrantFlow, they quickly identified their core eligible work: the development of a new machine-learning algorithm.

The platform walked them through the entire process:

- Pinpointing Expenditures: They easily tagged developer salaries and payments to contractors that were directly tied to the project.

- Crafting the Narrative: Our AI writer helped them structure the technical story, zeroing in on the specific technological hurdles they had to overcome.

- Automating the Forms: The system filled out the T661 for them, ensuring everything was accurate and compliant.

The result? What they saw as a bureaucratic nightmare became a straightforward process, and they submitted a claim with confidence. They secured a significant cash refund and immediately reinvested it into hiring another engineer to push their product development forward. By using the right tool, they didn't just save time—they maximized their return on innovation.

Your Top SR&ED Questions, Answered

Even with a solid overview of the SR&ED program, a few questions almost always pop up. Let's tackle the most common ones I hear from business owners. We'll skip the jargon and give you the straight answers you need to feel confident about your claim.

Think of this as your quick-reference guide for the nitty-gritty details that really matter.

What’s the Filing Deadline for an SR&ED Claim?

This is the one detail you absolutely cannot get wrong. You have exactly 18 months from the end of your company's fiscal year to submit your SR&ED claim.

So, if your fiscal year ends on December 31, 2024, the absolute last day you can file for that period is June 30, 2026. Miss that deadline, and you lose the entire claim for that year. The CRA is strict on this—there are no extensions or exceptions. It’s why staying on top of your documentation throughout the year is so crucial.

Do I Need a Finished Product to Qualify?

Not at all. This is probably the biggest myth about the SR&ED program. The tax credit isn't a prize for a successful product launch; it’s designed to reward the work you did to overcome technological challenges.

Your project could have been abandoned, put on hold indefinitely, or even ended up a total commercial failure. It doesn’t matter. What matters is the knowledge you gained along the way. Your claim needs to tell the story of that journey: the hurdles you couldn't overcome with standard practice, the experiments you ran to find a solution, and what you learned—win or lose.

Are There Any Big Changes Coming to the SR&ED Program?

Yes, and they're big ones. The government is giving the program a significant boost to better support Canadian innovators. The most recent federal budget rolled out some updates that will make a real difference for growing businesses.

A major overhaul is coming in Budget 2025. For work performed after December 15, 2024, the refundable credit limit for CCPCs is doubling from $3 million to $6 million. This pushes the maximum potential cash refund up to a hefty $2.1 million and expands the phase-out thresholds to $15-75 million of taxable capital.

In plain English, this means more small and medium-sized businesses will be able to claim the maximum refundable rate for longer. It’s a serious injection of non-dilutive funding. You can dig into the specifics of these SR&ED changes for 2025 on pwc.com to see how your company might benefit.

Ready to turn your innovation into funding without the administrative headache? GrantFlow’s AI-powered platform helps you discover your eligibility, craft a compelling claim, and get your SR&ED application filed faster. Stop leaving money on the table and see all the programs you qualify for at https://www.grantflow.ca.

Continue reading

Your Ultimate Guide to Job Grants Canada for Small Businesses

Unlock growth with job grants Canada. Our guide explains how to find and secure wage subsidies and hiring grants to scale your small business team.

Your 2026 Guide to the Top 7 Ontario Government Grant Resources

Discover the best resources for finding an Ontario government grant. Our 2026 guide covers top portals and tools to secure funding for your business.

Your Guide to Grants for Small Business in Canada

Unlock funding for your company with our complete guide to grants for small business in Canada. Learn how to find, apply for, and win government funding.