Your Guide to Grants for Small Business in Canada

When you hear "small business grant," what's the first thing that comes to mind? For many, it's the idea of "free money." And while that's technically true, it's a bit more nuanced than that.

A grant is a type of non-repayable funding offered by governments (and sometimes other organizations) to help entrepreneurs start, run, and grow their businesses. The key word here is non-repayable. Unlike a loan, you don't have to pay it back, which makes it an incredible way to fuel growth without taking on debt.

Understanding How Business Grants Really Work

The world of government funding can seem complicated at first, but the idea behind it is pretty simple. Don't think of a grant as a handout. Instead, see it as a strategic investment. A government body invests in a business that helps it achieve its own public policy goals, like creating jobs, fostering innovation, or boosting a specific region's economy.

This money is awarded to businesses that have a solid plan to use the capital for specific, measurable results. The government puts up the cash, and in return, your business helps strengthen the Canadian economy. It's a win-win.

Getting into the Grant Mindset

To be successful, you need to change how you think about grants. You aren't just asking for money. You're building a business case that proves your project aligns perfectly with what the funder wants to accomplish.

Your application is your pitch. It needs to show how your project will deliver a "return on investment" for the community or the country. This could look like:

- Hiring 5 new full-time employees in rural Alberta.

- Developing a new piece of software that makes Canadian manufacturing more competitive.

- Breaking into a new international market to increase Canadian exports.

At its core, you're partnering with the government to hit a shared target.

Grants Are Just One Piece of the Puzzle

It’s really important to know that grants aren't the only game in town. They sit alongside other funding tools like loans and tax credits, and each one has a different job. Applying for the wrong type of support is a classic mistake that wastes a ton of time and energy.

A loan, for example, is money you have to pay back with interest. A tax credit reduces your tax bill after you’ve already spent the money on approved activities. Grants, on the other hand, are direct cash injections to fund projects you haven't started yet.

Key Takeaway: A grant is a non-repayable award tied to a specific purpose. It's performance-based, meaning you have to follow through on your proposal to help achieve goals that benefit the wider economy.

To help you see the differences clearly, let's quickly compare the main types of funding you'll come across.

Funding Types at a Glance: Grants vs. Loans vs. Tax Credits

This table breaks down the key distinctions to help you figure out which path is right for your business needs.

| Funding Type | What It Is | Repayment Required | Best For |

|---|---|---|---|

| Grants | Direct, non-repayable cash for specific projects (e.g., hiring, R&D, market expansion). | No. | Fuelling specific growth projects without taking on debt, especially for innovation or job creation. |

| Loans | Capital borrowed from a lender (like BDC or a bank) that must be paid back with interest over time. | Yes. | Covering major expenses like equipment purchases, managing cash flow, or financing large-scale operations. |

| Tax Credits | A reduction in the taxes you owe, based on money you've already spent on eligible activities (e.g., SR&ED). | No. | Recovering a portion of past expenditures on R&D, hiring apprentices, or investing in specific sectors. |

Understanding these fundamental differences is the first step in building a smart funding strategy that actually works. Now you can start matching your business needs to the right kind of support.

The Four Main Types of Government Funding

Alright, now that we’ve got the right mindset, let’s get into the good stuff: the money itself. When people talk about "government funding," they're usually thinking of a simple cash handout. But in Canada, the reality is a lot more nuanced—and a lot more interesting.

Think of it like building a toolkit for your business. You wouldn’t use a hammer for every single job, right? Same idea here. The government offers different kinds of support for different needs, and the smartest entrepreneurs learn how to use each tool effectively, sometimes even in combination.

Understanding these four main pillars is the first real step to matching your business goals with the right funding program.

1. Direct Grants

This is the one everyone dreams about. A direct grant is exactly what it sounds like: a non-repayable sum of money given to your business for a very specific purpose. It’s the closest thing to “free money” you’ll find, designed to spark innovation or growth in areas the government wants to support.

For instance, a cleantech company might land a grant to build a prototype for a new water purification system. The government isn't buying shares or asking for the money back; it's investing in a project that could create jobs, solve a pressing environmental issue, and cement Canada's reputation as a tech leader.

But here’s the catch: these grants are incredibly competitive and are always tied to concrete results. You can't just ask for a cheque to "grow the business." You need a rock-solid project plan with a detailed budget, a clear timeline, and measurable goals.

2. Wage Subsidies

Hiring new staff is one of the biggest and scariest expenses for any small business. Wage subsidies are designed to take some of that weight off your shoulders. In a nutshell, the government agrees to pay for a portion of a new employee's salary for a fixed amount of time.

This is a game-changer for de-risking your expansion plans. Let's say you want to bring on a brilliant computer science intern for six months to develop a new feature for your app. A wage subsidy program could cover 50% to 75% of their salary, making that hiring decision a whole lot easier to justify.

These programs are often targeted to meet specific economic and social objectives, focusing on groups like:

- Youth: To give young Canadians a foothold in their careers.

- Skilled Trades: To fill labour gaps by supporting apprenticeships.

- Underrepresented Groups: To foster a more diverse and inclusive workforce.

When you use a wage subsidy, you’re not just getting help with payroll—you’re actively participating in a national workforce strategy, which makes for a very strong application.

A wage subsidy is really a co-investment in your team. The government shares the financial risk of hiring, which lets you build out your workforce faster and with more confidence.

It's a true win-win: you grow your business, and a fellow Canadian gets valuable work experience.

3. Tax Credits

Unlike grants that put cash in your hand upfront, tax credits work in reverse. They let you claw back a percentage of the money you've already spent on certain activities, usually by slashing your corporate income tax bill. If the credit is refundable, you might even get a cash refund from the government if the credit amount exceeds what you owe in taxes.

The most legendary example in Canada is the Scientific Research and Experimental Development (SR&ED) program. If your company is doing R&D to build new things or make existing things better, a huge chunk of your related costs—like your developers' salaries or materials for prototypes—can be claimed back.

Let's put that in perspective. Say you spent $100,000 on eligible R&D work. Through SR&ED, you could potentially get more than 60% of that back, depending on your province and company size. It’s not a grant you apply for in advance; it’s a claim you file with your taxes, turning your innovation budget into a powerful financial asset.

4. Government-Backed Loans

We all know loans have to be paid back, but government-backed loans are a different beast entirely. They come with far better terms than you could ever get from a bank on your own. The government doesn't usually lend the money itself. Instead, it acts as a guarantor, promising to cover a portion of the loan if you default.

This government guarantee dramatically lowers the risk for the bank or credit union, making them much more willing to lend to small businesses, especially those that are young or don't have a long credit history. The Canada Small Business Financing Program is a perfect example of this in action.

Because the lender is taking on less risk, you get access to capital with some serious perks:

- Lower interest rates

- Longer repayment windows

- Less demanding collateral requirements

This kind of funding is ideal for big-ticket items like buying new machinery, purchasing your first commercial property, or financing a major expansion. It bridges a crucial gap for businesses that are primed for growth but don't quite fit the rigid mould of traditional lenders.

What Funders Look For in an Applicant

Every founder wants to know the secret sauce for winning grants. It all boils down to one simple question: "Am I even eligible?" While it's easy to get lost in the jargon of program guides, funders are generally looking for the same core things. If you can nail these fundamentals, you’ll be able to quickly assess your own grant readiness and stop wasting time on applications you can't win.

Think of it like applying for a job. You wouldn't send a chef's resume for an accounting role, right? In the same way, your business needs to perfectly match the "job description" of the grant program. It’s not just about having a fantastic idea; it’s about meeting the specific, non-negotiable criteria the funder has laid out.

Foundational Eligibility Criteria

Before you even start writing about your brilliant project, your business itself has to pass the first hurdle. Funders use these baseline criteria to filter out applicants who aren’t a good fit from the get-go.

Most programs will have firm rules about:

- Business Structure: Many grants are strictly for incorporated businesses (federally or provincially). Others might be open to partnerships or even sole proprietors. This is often the very first box you need to check.

- Operational History: Funders want to see that you’re not a fly-by-night operation. They often require a minimum track record, typically between one and three years, to prove you have a stable business model.

- Employee Count: Some funding is tailored for micro-businesses with fewer than five employees. Other programs target larger SMEs with 50 or more staff, usually because their focus is on significant job creation.

- Revenue Thresholds: You might need to show minimum annual revenues (e.g., $100,000 or more). This assures the funder that your business is financially healthy enough to actually deliver on the project you’re proposing.

These aren't just suggestions—they are hard stops. If a program requires three years of financial statements and you’ve only been in business for two, you simply don't qualify. End of story.

Crucial Insight: Don't waste a minute on grants where you don't meet the basic eligibility. It's the number one reason applications get tossed before they're even read. Focus your energy where you have a real shot.

The Concept of Program Fit

Okay, so you’ve checked all the basic boxes. That’s just the start. The real secret to a winning application is demonstrating strong program fit. This means showing that your project's goals align perfectly with the government's own economic objectives.

It's not enough to be a great business; you have to be the right business for that specific grant. A funder isn't just handing you cash—they're investing in you to help them achieve a policy goal. These goals often revolve around very specific outcomes.

For example, a program might be designed to:

- Drive Innovation: Backing businesses that are developing new technologies or doing groundbreaking research.

- Increase Exports: Helping Canadian companies break into new international markets.

- Create High-Quality Jobs: Funding projects that will lead to hiring skilled workers in Canada.

- Promote Regional Development: Sparking growth in specific provinces, territories, or rural communities.

To put this in perspective, think about Canada's largest province. As of the latest data, Ontario had 22,828 small businesses with paid employees. To support them, an agency like FedDev Southern Ontario might offer repayable contributions starting at $125,000 for established firms that have at least five employees, have been running for three years, and have a clear plan for expansion and job creation. You can find more insights on the business landscape and funding on VitalityCash.com.

Your application needs to tell a compelling story about how your project is a direct pipeline to these larger goals. When you clearly connect your business outcomes to the funder's mission, your application transforms from a simple request for money into a powerful proposal for a partnership. That alignment is what separates the winners from everyone else.

Major Canadian Grant Programs You Should Know

Alright, let's move from theory to reality. We've covered the what and the why of grants, but now it's time to get into the specifics. The Canadian funding landscape is huge, but a few key programs pop up again and again as cornerstones for small business growth.

Getting to know these big players will make the whole grant world feel less abstract and a lot more accessible. Think of them as your starting lineup—each one is designed to tackle a specific business challenge, from fuelling early-stage research to helping you hire your next wave of talent.

Fuelling Innovation with IRAP

If your small or medium-sized Canadian business is working on anything related to technology, the Industrial Research Assistance Program (IRAP) is a name you absolutely need to know. It’s run by the National Research Council of Canada (NRC) and is hands-down one of the country's most respected and impactful programs for innovation.

IRAP's whole purpose is to help businesses like yours break through technical barriers and fast-track research and development. It does this in two ways: first, with expert technical advice, and second, with non-repayable cash. An NRC-IRAP Industrial Technology Advisor (ITA) works directly with you to understand your project. If it's a good fit, they can champion your application for funding, which usually covers a chunk of your R&D salary costs.

This program is perfect for businesses that are:

- Developing a brand-new product, service, or process.

- Making an existing one better in a technologically innovative way.

- Trying to solve a tricky technical problem that requires some serious research.

The funding can cover a significant percentage of the technical payroll for the project, making it a lifeline for tech-focused companies. You can explore the program details on our site to get a better sense of how it works.

Recovering R&D Costs with SR&ED

While IRAP helps fund what you're about to do, the Scientific Research and Experimental Development (SR&ED) tax incentive program helps you get money back for what you've already done. It’s not a grant in the classic sense, but it acts like one by providing some pretty hefty cash refunds for eligible R&D work you’ve carried out in Canada.

If your business is experimenting to advance science or technology—even if you fail—you could be eligible. A lot of companies are actually doing SR&ED-eligible work without even realizing it.

Key Insight: SR&ED is one of the most generous programs of its kind on the planet. For a Canadian-controlled private corporation (CCPC), refundable credits can be as high as 35% of qualified expenditures. It’s a powerful way to stretch your R&D budget further.

The program lets you claim back a portion of all sorts of expenses, from salaries and materials to some of the overhead costs tied to your R&D.

Boosting Your Team with Wage Subsidies

Hiring is one of the biggest expenses for any growing business. Wage subsidies are designed to hit that pain point directly. Programs like Canada Summer Jobs or various co-op placement funds offer money to cover part of a new employee’s salary, usually for a set period.

These grants are often aimed at creating opportunities for specific groups like students, new grads, or people from underrepresented communities. When you participate, you’re not just getting financial help to grow your team; you're also contributing to Canada's workforce development. It's a smart way to de-risk the hiring process and bring in some fresh talent.

Tapping into Regional and Provincial Support

Beyond these federal giants, there’s a whole ecosystem of provincial and regional grants designed to support local economic goals. These programs are often less competitive and more dialed into the specific needs of a region's industries. They are a critical, and often overlooked, source of funding.

To give you an idea, let's look at the variety of funding opportunities available. The table below highlights just a few of the major federal and provincial programs that support businesses across Canada.

Key Federal and Provincial Grant Programs

| Program Name | Focus Area | Funding Type | Ideal Applicant Profile |

|---|---|---|---|

| IRAP | R&D, Technology Innovation | Grant | SMEs with innovative tech projects and technical staff. |

| SR&ED | R&D, Experimentation | Tax Credit / Refund | Any company performing R&D to overcome tech uncertainty. |

| Canada Digital Adoption Program (CDAP) | Digital Transformation | Grant & Loan | Businesses looking to adopt e-commerce or new tech. |

| CanExport SMEs | Export, Market Expansion | Grant | Small businesses ready to explore international markets. |

| Southwestern Ontario Development Fund | Regional Growth, Job Creation | Grant | Businesses in SW Ontario investing in expansion. |

| Strategic Innovation Fund (SIF) | Large-Scale Innovation | Repayable & Non-Repayable | Larger-scale businesses with transformative projects. |

This is just a snapshot, but it shows how targeted funding can be. Every province and territory has its own suite of programs. Whether it’s support for agricultural businesses in Saskatchewan or for digital media companies in British Columbia, taking the time to explore these local opportunities can unlock significant funding that is perfectly aligned with your business.

A Step-By-Step Plan for Applying to Grants

Let’s be honest: trying to get a grant for your small business can feel like you’re navigating a maze in the dark. But it doesn’t have to be that way. The secret isn’t just chasing deadlines; it’s building a repeatable system that turns chaos into a clear, predictable path.

This isn’t about just filling out forms. It’s about shifting from a reactive, last-minute scramble to a proactive, strategic part of your business. When you have a solid workflow, you can focus your energy on telling a compelling story instead of frantically hunting for documents.

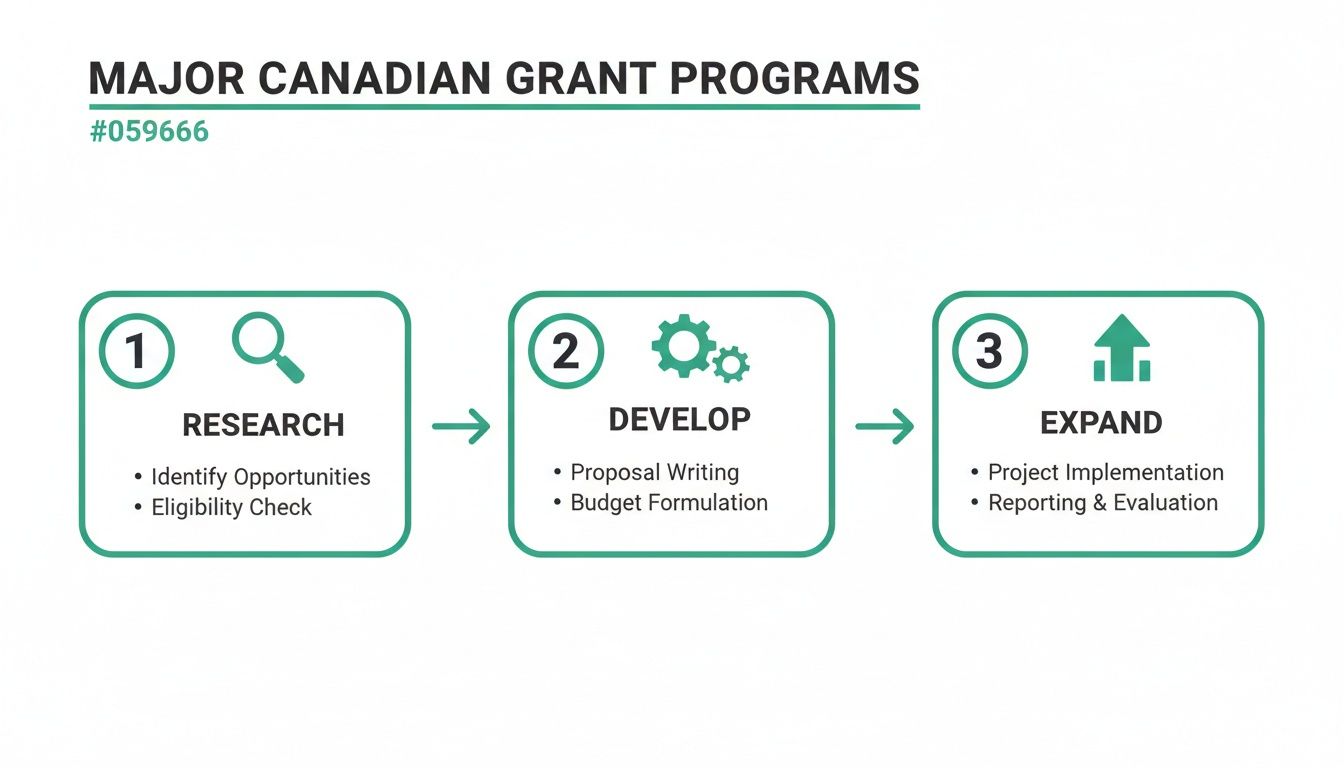

This infographic breaks down the journey into its three core stages: finding the right programs, building a strong case, and using the funds to grow.

Think of it as a cycle. You discover an opportunity, develop a winning proposal, and then expand your business, which in turn opens up new funding opportunities. Let's walk through exactly how to make this process work for you.

Step 1: Discover and Vet Opportunities

The first, and most critical, step isn't just finding grants—it's finding the right ones. One of the biggest mistakes business owners make is the "spray and pray" approach, applying for anything that looks remotely relevant. Your time is far too valuable for that.

Start by mapping out potential programs on a "grant calendar." As you add one, your immediate next move is to download the official program guide. This document is your new best friend. Read it cover to cover, paying special attention to the hard-and-fast eligibility criteria.

If you don't meet 100% of the non-negotiable requirements—things like your incorporation status, annual revenue, or years in business—be ruthless. Cross it off your list and move on. This tough vetting upfront will save you dozens of hours on applications that were never going to succeed.

Pro Tip: Don't be fooled by a grant's catchy title or a quick summary. The real rules are buried in the program guide. A program for "Canadian Tech Innovators" might sound perfect, but the fine print could require three years of financial history, immediately knocking a brilliant new startup out of the running.

Step 2: Build Your Narrative and Align Your Goals

Once you've found a grant you actually qualify for, your job is to become a storyteller. A grant application is not a dry list of facts; it’s a persuasive pitch that connects what your business needs with what the funding agency wants to achieve.

Begin by outlining your project with absolute clarity. What, exactly, will you do with the money? How will you track and measure success? You’ll want to frame your objectives using the specific language you found in the program guide. If the funder's mission is "creating high-skill jobs in Northern Ontario," your story must show precisely how your project does that.

From the reviewer's perspective, your application needs to convincingly answer three questions:

- Why this project? Clearly define the problem you're solving or the opportunity you're seizing.

- Why our business? Show off your team's expertise, your company's track record, and what makes you uniquely qualified to pull this off.

- Why now? Create a sense of urgency. Connect your project to current market trends, economic needs, or a window of opportunity that's about to close.

A winning application makes the connection between your goals and theirs impossible to ignore. For more on this, we've got some great advice on how to stand out and explore grant writing opportunities in our other articles.

Step 3: Assemble Your Documentation

This is the step that trips up so many businesses and leads to that all-too-familiar late-night panic. The solution is simple but powerful: create a "grant toolkit." This is just a digital folder on your drive where you keep all your essential documents, updated every quarter.

Think of it as your grab-and-go bag for funding.

Your toolkit should have clean, up-to-date versions of these core documents:

- Corporate Documents: Your Certificate of Incorporation, business numbers (GST/HST), and any shareholder agreements.

- Financial Statements: At least your last two years of financials (income statement, balance sheet, cash flow statement).

- Business Plan: The most current version, complete with your market analysis and growth strategy.

- Team Biographies: Short, professional bios for key team members that highlight their relevant experience.

- Project Budget: A detailed, realistic budget for what you’re proposing, backed up with quotes for any major expenses.

With these files always at the ready, putting together an application package becomes a quick and simple task. This level of preparedness doesn't just cut down on your stress—it sends a clear signal to funders that you are an organized, professional, and serious applicant.

Let’s be honest: hunting for small business grants the old-fashioned way is a nightmare. You spend hours, maybe even days, bouncing between government websites, trying to decipher jargon-filled program guides, and frantically tracking deadlines on a spreadsheet. It’s a full-time job in itself.

This administrative grind is exactly why so many Canadian businesses throw in the towel before they even start. The whole process feels clunky, confusing, and completely overwhelming. The result? Money gets left on the table.

Thankfully, there's a much smarter way to do this. Instead of drowning in a sea of browser tabs, you can use one central platform to handle everything from finding the right grant to getting your application over the finish line.

Take a look at how a simple company profile on a platform like GrantFlow can instantly pull up a list of opportunities you’re actually a good fit for.

This one image shows the difference perfectly. It’s the shift from a chaotic, manual search to a clean, organized dashboard that tells you exactly what to do next. That's a huge time-saver.

A Central Hub for Your Funding Strategy

Think of a platform like GrantFlow as your command centre for all things funding. You plug in your company’s details—industry, location, size—and it does the heavy lifting for you. In an instant, you get a personalized list of matched grants, pulled from a database of over 785+ programs across Canada.

This completely flips the script. Instead of you chasing down grants, the right grants come directly to you.

Key Takeaway: Using a dedicated grant platform lets you stop wasting time on the search and start focusing on what really matters: building a winning application.

Speeding Up the Application Itself

Finding the perfect grant is just the first step. The real work begins when you have to write a compelling application. This is where most people get bogged down, but modern tools can help here, too. For instance, an AI-powered Application Writer can help you draft initial answers based on your project details and what the program is looking for.

This isn’t about replacing your voice; it's about giving you a powerful starting point. It's a co-pilot that helps you get past that dreaded writer's block and ensures your responses hit all the key points funders care about.

Beyond just the writing, these systems are built to keep you organized:

- Application Trackers: See the status of every single application—submitted, pending, approved—all in one place.

- Deadline Alerts: Get automated reminders so a crucial submission date never sneaks up on you.

- Content Libraries: Save your best answers from previous applications to quickly reuse and adapt for new ones.

By pulling all these pieces together, this technology makes the complex world of grants for small business feel manageable and, most importantly, effective. It gives you the confidence to stop missing out and start securing the funding your business needs to grow.

Your Grant Questions, Answered

Diving into the world of grants always brings up a few key questions. It's a complex space, so let's clear up some of the most common things we hear from entrepreneurs across Canada.

How Much Money Can I Actually Get From a Grant?

This is the big one, and the honest answer is: it's all over the map. You might find a local grant from your municipality offering a couple of thousand dollars to help you upgrade your storefront. On the other end of the spectrum, a major federal program like the Strategic Innovation Fund could be backing projects with millions.

For things like wage subsidies, it's common to see them cover 50-75% of an employee's salary up to a set limit. The trick is to think of grants as a contribution to a project, not a blank cheque to fund your entire operation.

Do I Need to Hire a Professional Grant Writer?

Not always, but it can make a real difference. If you're going after a smaller, pretty straightforward grant, you can absolutely tackle it yourself with some good organization and a clear plan.

However, when you're aiming for those highly competitive federal programs or wading into something complex like an SR&ED claim, a pro's touch can be invaluable. They're experts at telling your story in a way that ticks all the boxes for the people reading the application.

Key Insight: Whether it's you or a hired writer holding the pen, the goal is the same: create a crystal-clear, compelling narrative that answers every single question in the program guide.

Can a Brand New Startup Get a Grant?

Yes, but you'll have to be strategic. It's true that many grant programs want to see a track record—often one to three years in business with some revenue to show for it.

That said, there are specific funds designed just for early-stage companies, especially if you're in a hot sector like tech, cleantech, or scientific research. Keep an eye out for programs focused on "pre-commercialization" or those offered through local innovation hubs and incubators.

How Long Does This Whole Process Take?

Patience is a virtue here. A simple wage subsidy application might get a thumbs-up in just a few weeks. But if you're applying for a major federal grant with multiple stages, you could be looking at six months—or even longer—from the day you submit to the final decision. Always build that timeline into your business planning.

Stop leaving money on the table. GrantFlow uses AI to instantly match your business with over 785+ Canadian grants you actually qualify for. Start your free trial and find your funding in minutes at https://www.grantflow.ca.

Continue reading

What Is SR&ED Tax Credit A Guide for Canadian Innovators

Discover what is SR&ED tax credit and how it can fund your R&D. Our guide explains eligibility, calculations, and how Canadian SMEs can maximize their claims.

Your Ultimate Guide to Job Grants Canada for Small Businesses

Unlock growth with job grants Canada. Our guide explains how to find and secure wage subsidies and hiring grants to scale your small business team.

Your 2026 Guide to the Top 7 Ontario Government Grant Resources

Discover the best resources for finding an Ontario government grant. Our 2026 guide covers top portals and tools to secure funding for your business.